A growing number of jurisdictions are providing partial wage replacement when employees take leave for certain family or medical reasons. These paid family leave (PFL) programs are typically funded through payroll deductions. This Tip provides an overview of existing PFL laws.

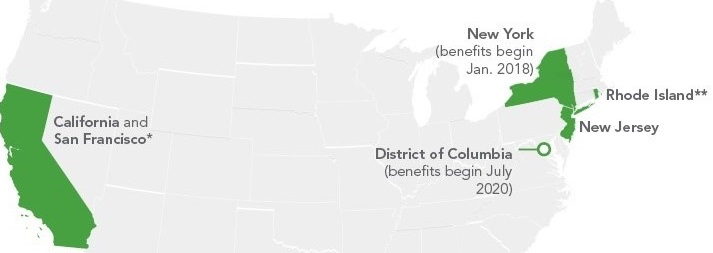

Current PFL Laws. The following jurisdictions have enacted PFL laws:

California | San Francisco* | New Jersey | New York | Rhode Island** | District of Columbia

* San Francisco employers with 20 or more employees must supplement the state’s benefits when an employee takes time off to bond with a new child. This requirement went into effect on January 1, 2017 for employers with 50 or more employees. Employers with 35 to 49 employees must comply by July 1, 2017. Employers with 20 to 34 employees must comply by January 1, 2018.

** Rhode Island's PFL program is referred to as Temporary Caregiver Insurance.

Covered Absences. Eligibility for wage replacement benefits varies under each law, but the benefits generally cover time off for an employee to:

- Bond with a newborn or a newly placed adopted or foster child.

- Care for a family member with a serious health condition.

DC also covers time off for the employee's own serious health condition. And, New York covers time off for families to manage the responsibilities that ensue when a spouse, domestic partner, child or parent is on active duty or has been notified of an impending call to active duty.

The federal Family and Medical Leave Act and similar state laws entitle covered employees to unpaid, job protected leave for absences that may also be covered by PFL. In such cases, the leave generally can run concurrently under the various laws.

Wage Replacement Benefits. Apart from DC and San Francisco, PFL programs are funded solely by employees via payroll deductions and provide partial wage replacement benefits when an employee has a covered absence from work. DC's program will be funded by employers via a tax on employees' wages. San Francisco is phasing in a requirement to provide full wage replacement benefits, but it only applies to time off for bonding with a newborn or newly placed child. Employers in San Francisco will be required to supplement the state benefit by paying the remaining portion of the employee's normal pay.

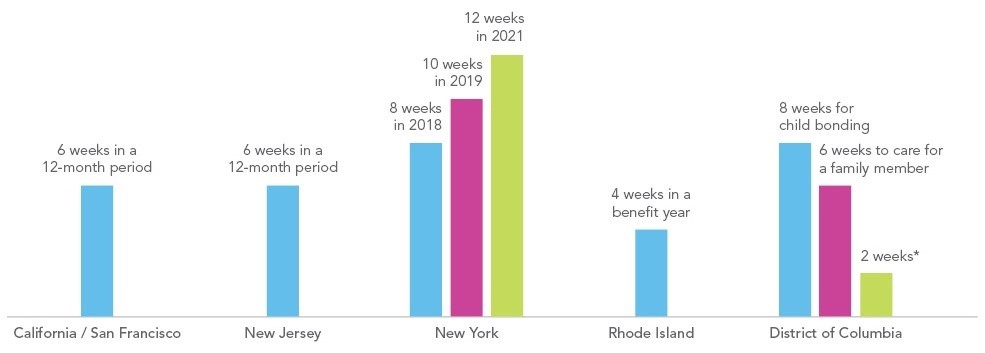

Maximum Duration of Benefits. The maximum duration of benefits in each jurisdiction is depicted below:

* In DC: 2 weeks for the employee's own health condition (PFL is limited to 8 workweeks of benefits in a 52-workweek period, regardless of the number of qualifying events)

Job Protection. Some of these laws have express job-protection provisions. For example, in New York and Rhode Island, employees returning from PFL must be reinstated to the position they held before the start of the leave, or to a comparable/equivalent position. In other states, the PFL programs may merely provide a financial benefit rather than a leave entitlement with job protection. However, even in states without express job-protection provisions for PFL, employees may be protected under another federal, state, or local law. For example, California's PFL law doesn't specifically offer job protection, but an employee's absence may be protected under the federal Family and Medical Leave Act, California Family Rights Act, or paid sick leave law.

Notices. PFL laws generally require employers to provide a notice to employees about their rights and/or post a notice in the workplace.

Conclusion. If you have employees in any of the jurisdictions covered above, understand your rights and obligations under the law and train supervisors on how to respond to leave requests. We expect to see the PFL trend continue, so watch for developments in other jurisdictions as well.