Overview. Recently, we reported the Oregon Bureau of Labor and Industries (BOLI) had modified its interpretation of the overtime rules governing daily and weekly overtime calculations for mills, factories, and manufacturing establishments published in the Technical Guidance (the “Guidance”). On March 9, 2017, in Mazahua Reyes v. Portland Specialty Baking, LLC, Multnomah County Circuit Judge Kathleen Dailey held that employees working in mills, factories, and manufacturing establishments are entitled only to the greater of daily or weekly overtime pay in a workweek, not both.

Details. Oregon law requires employers to pay non-exempt employees 1.5 times their regular rate of pay for hours worked in excess of 40 in a workweek. The state also requires mills, factories, and "manufacturing establishments" to pay non-exempt employees 1.5 times their regular rate of pay for hours worked in excess of 10 in a workday.

A "manufacturing establishment" is any place where machinery is used for "manufacturing purposes," which includes:

· The process of making goods or any material produced by machinery;

· Anything made from raw materials by machinery; and

· The production of articles for use from raw or prepared materials by giving such materials new forms, qualities, properties or combinations, by the use of machinery.

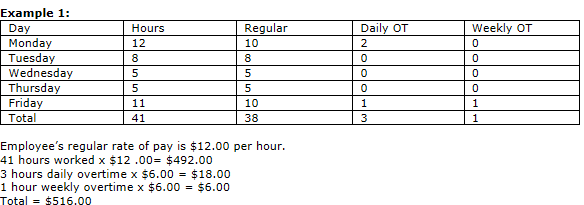

In its Guidance, BOLI says that when non-exempt employees of mills, factories, and manufacturing establishments work more than 10 hours in any day of the workweek and more than 40 hours in the workweek, the employer should calculate overtime on both a daily and weekly basis and then pay both amounts. The following example taken from the Oregon Bureau of Labor and Industries’ website:

Call to Action. Covered employers should review the guidance and their overtime calculation practices to determine if changes are necessary. Additional FAQ’s can be found here at Oregon.gov.

As always, please contact your Relationship Manager or your Service Team with any questions.